UPI Payment Gateway And Use Of Distributed System In Banking

What is a payment gateway ?

It the technology that captures and transfers payment data from the customer to the acquirer and then transfers the payment acceptance or decline back to the customer. A payment gateway validates the customer’s card details securely, ensures the funds are available and eventually enables merchants to get paid. It acts as an interface between a merchant’s website and its acquirer. It encrypts sensitive credit card details, ensuring that information is passed securely from the customer to the acquiring bank, via the merchant.In other words, the payment gateway works as the middleman between your customer and the merchant, ensuring the transaction is carried out securely and promptly.

Why do we need a payment gateway?

What would happen if you take the payment gateway out of the online payment flow? Fraudsters would have easier access to card data you process, exposing your business to fraud and chargebacks. On top of that, fraudsters would also find additional ways to initiate illegitimate transactions, leaving you even more exposed to fraud and damaging your brand reputation.

A payment gateway is the gatekeeper of your customer’s payment data. For online merchants, a payment gateway relays the information from you, the merchant, to the acquirer and the issuing bank using data encryption to keep unwanted threats away from the sensitive card data. Aside from fraud management, a payment gateway also protects merchants from expired cards, insufficient funds, closed accounts or exceeding credit limits.

UPI

Unified Payments Interface, or UPI (this is important, remember this acronym), was created with the sole purpose of enabling interoperability. It is a platform that is simultaneously backward compatible and future proof — a common language.

But as is usually the case with well designed systems, UPI ended up unleashing a tsunami of economic potential along the way. To understand why UPI is as powerful as it is, and how it completely changes the payments landscape, we must first understand how any payments system operates.

A brief detour into current payment gateways

Any two-way payment transaction starts with the need for an entity (the sender) to transfer value to another entity (the receiver). Both the sender and the receiver could be individuals, merchants, or government organizations. While cash has worked well in the past, there are several scenarios where cash is not the optimal solution for transfer of value. To use any other form of payment transaction, the following requirements must be met:

Sender Authentication

The sender of the payment must authenticate his or her identity. i.e., prove to the banks that they are who they claim to be. In India, this takes the form of two-factor authentication. Each payment must be accompanied by two different conformations from the sender.

Receiver Identification

The recipient of the payment must be successfully identified. This usually involves knowing the recipient’s name, bank information, and account number. Current payments solutions address this need in their own unique ways.

Authorization

Once the sender has been authenticated and the receiver has been identified, the bank goes ahead and authorizes the transaction. This process involves sending the following information to the payments rails: transaction value, sender ID and receiver ID.

Transaction (Value Transfer)

This is where the payments rails come in. Information from the authorization step and actual monetary value travel over the rails.

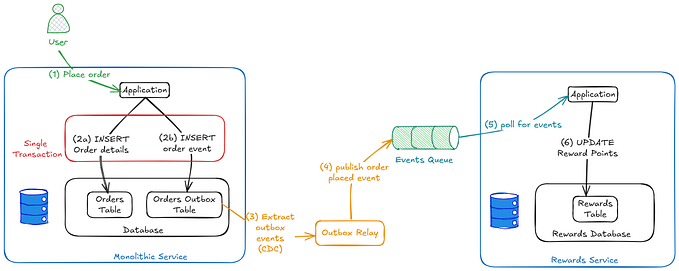

These steps have been summarized in the following diagram.

A Payment Gateway focuses on creating a secure pathway between a customer and the merchant to facilitate payments securely. It involves the authentication of both parties from the banks involved.

The most significant advantage of a payment gateway is the fact that it allows millions of users to use it at the same time, making it possible for you to purchase or sell goods and services whenever you want.

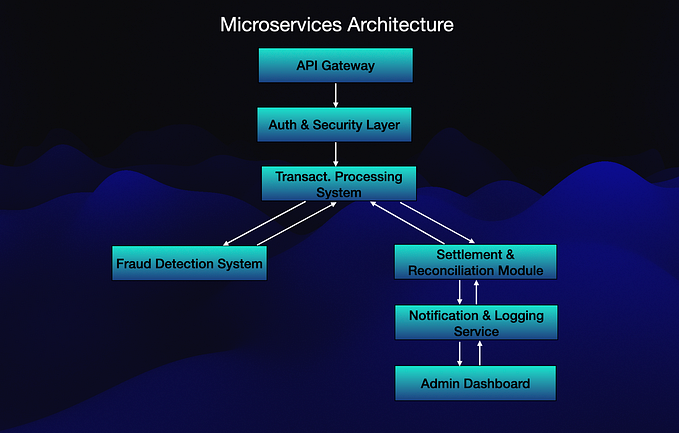

Use Of Distributed System

The payment request are not handled by only one server .There are many sub servers to do this task . The data regarding transactions, credit card, debit card credentials,customer account details, OPT, PIN etc. is stored in the Bank servers and data centres.

It is totally secured because the National Payment Corporation of India (NCPI) made it clear that the all the storage of payment system related data shall be stored in system located only in India .

The information stored is not centralised at main server. Because if the whole data is stored at main server then there may be a problem of rush, bottleneck, losing all the data, If in case whole data gets lost due to hacking or if there is any problem in server the server all the system may be at halt.But if it is distributed then the only smaller portion of the system is affected .

The user while making the transaction only deals with the particular sub server and do not send request to main sever. If required the sub servers communicate to the main server for some details. The regional/sub servers acts as a firewall to the main server of the system .This increases the reliability and security of the main server,as the threats to the main server can be avoided. Also the data flow take place smoothly due to sub servers and bottleneck problem can be avoided . So, using distributed Systems ,the service has become more efficient which eases the transaction.